Finance Industry

The finance industry is undergoing a major transformation due to the rapid adoption of new technologies. Some of the key trends that are changing the finance industry include the adoption of robotic process automation (RPA) and AI-powered chatbots for automating manual tasks, as well as the rise of DeFi and open banking, which are democratizing financial infrastructure and data access.

Our Key Solution Areas

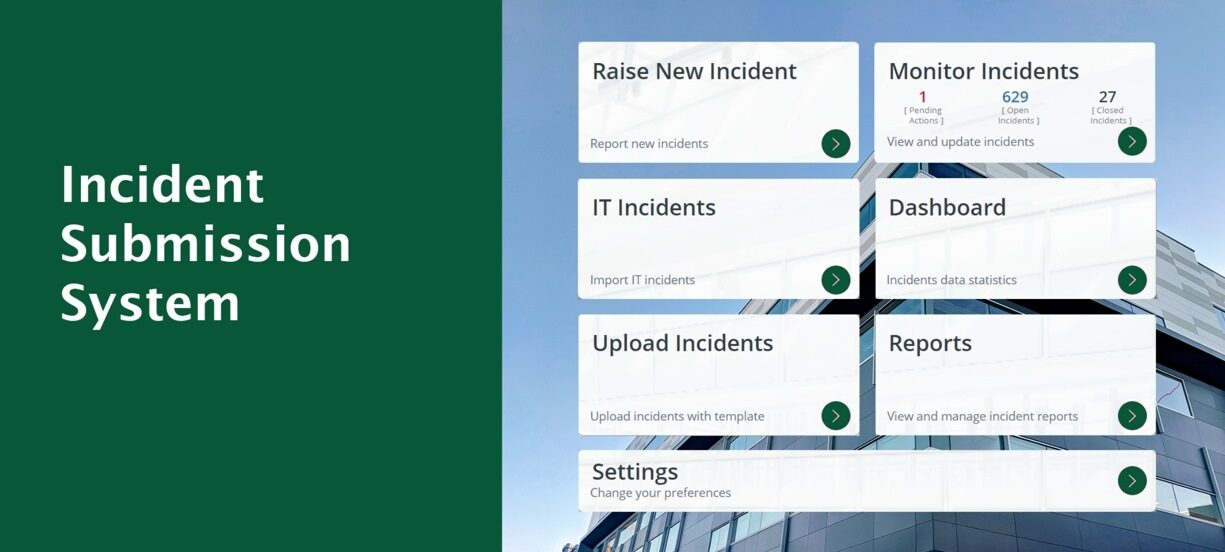

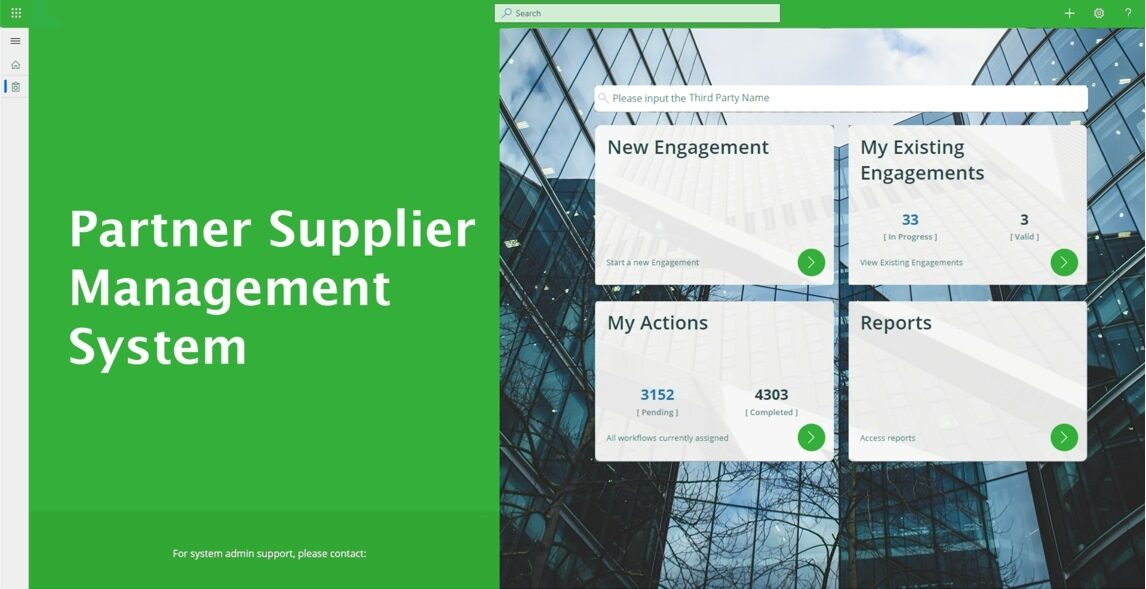

- Risk Submission System

- Regulation Monitoring Portal

- Financial Crime Prevention

- Application Modernization

- Legacy System Modernization

- Microservice Architecture

- Personalized Banking Experience

- Mobile Banking

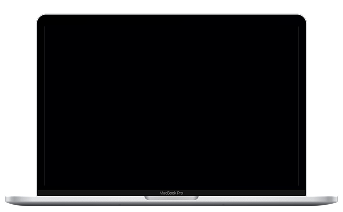

- Loan Management System

- AI-powered KYC System

- Document Processing Solution

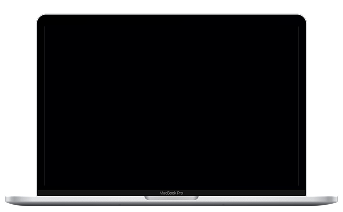

- Product Approval System

Our Success Stories in Finance Industry

One of the World's Largest Banks

Our client, a renowned global bank, was facing challenges in effectively analyzing vast amounts of customer data to drive personalized experiences and make data-driven decisions.

By automating data processing, generating actionable insights, and enhancing customer segmentation, our GenAI service enabled our client to deliver personalized financial solutions, deepen customer relationships, and drive significant business growth.

With Bamboo's GenAI service, our client achieved remarkable results, including a 30% increase in customer satisfaction, a 25% boost in cross-selling opportunities, and a 20% improvement in operational efficiency.

A Leading Property Group in Hong Kong

A leading property group in Hong Kong sought to enhance their operational systems and data management. Bamboo Technologies stepped in with their GenAI solutions, introducing a GenAI-powered chatbot tailored for the property industry. This innovative tool allows business users to interact seamlessly with structured data and operational systems, posing queries and receiving accurate answers promptly.

The chatbot's deployment marked a significant leap in efficiency, particularly in handling payment-related inquiries. It streamlined the process, reducing the time and resources previously required for such tasks. The result was an astounding 80% improvement in efficiency, transforming the way the property group managed their financial operations.